The table above clearly shows that the new rates are lower than the standard rates of tax. But one has to give up some of the most notable benefits available under the Income Tax Act. A complete list of the deductions which one has to give up is as follows:-

- Section 10(5) [Leave travel allowance ]

- Section 13(A) [House rent allowance i.e. HRA ]

- Section 10(14) [Special allowance except prescribed items ]

- Section 10(17) [Allowace to MP's and MLA's ]

- Section 10(32) [Exemption from Minor's Income up to Rs. 1500 ]

- Section 16 [Standard Deduction from the Salary Head, entertainment allowance and professional tax ]

- Section 24 (b) [Interest on loan for a house which is self occupied]

- Section 10AA [Exemption to SEZ Units]

- Section 32(1)(iia) [Additional Depriciation]

- Section 32AD, 33AB, 33ABA

- Section 35(i)(ii)/(iia)/(iii) and 35(2AA) [Deductions in respect of certain payments to research association, university, college and national laboratory, etc.]

- Section 35 [Investment related deductions in certain specified sectors ]

- Section 35CCC [Expenditure on agriculture extension project]

- Section 57(iia) [Deduction from the family pension]

- All Chapter VI-A deductions except

- Section 80CCD(2) [ Employers contribution to pension fund]

- Section 80JJA [Deduction fro additional employee cost]

- without any exemption or deduction for allowances or perquisite, by whatever name called, provided under any other law for the time being in force.

Also, if an individual in earlier years declared some loss on account of the above-mentioned list items then as per the new

scheme such person cannot take benefit of such losses in the current year. In short, no set-off of 'brought forward' losses.

The second last point in the above list deserves some special attention. If an individual or a HUF wants to pay taxes at a lower rate then they must be

willing to sacrifice the benefit of sections 80C, 80D, 80TTA, 80G, etc. These are some of the most prominent tax benefits.

Every individual is aware that a life insurance policy, a PPF investment, or tuition fees of his children helps in saving tax.

This new scheme requires you to forgo all these benefits.

So clearly, we face a trade-off, either pay taxes at a lower rate or pay taxes on a lower level of income.

We have been getting many queries regarding whether one should opt for this new scheme or continue to pay taxes as per the old scheme.

The answer to this question depends on the facts of each case.

The tax amount may get reduced even if one does not takes the benefit of any such deduction and simply pays taxes at a lower rate.

So can we make a generalization or a rule of thumb about whether this new scheme is beneficial or not?

In a nutshell, 'Yes!', there is a rule of thumb for us.

It is as follows: -

If the total of all the deductions mentioned in the list above is more than Rs. 2,50,000/-

then this new scheme is not beneficial at all.

From a practical point of view, this might be all you may want to know. All furhter details can be skipped, if required.

But how do we arrive at such a figure? One approach could be simple trial and error.

What we can do is calculate taxes at different levels of income and deduction amounts.

We need to calculate taxes according to the new Section 115BAC and the standard tax rates.

Then we can compare the tax amounts to see which scheme is better. Hopefully, we can find some pattern.

It would be very time-consuming to make such calculations by hand. Thankfully, we have technology on our side.

We can ask a computer to do the tedious calculations. For this task, we will use Python. Python is an open-source, multipurpose programming language.

It is just a fancy way of saying that Python is free of cost and can do many amazing things.

The source code for the Python can be seen here

We will first calculate the tax1. amount as per standard rates for different income levels assuming that the person will not take benefit of any deduction

mentioned in the above list. We will then calculate tax1. according to Section 115BAC after which we can compare which is more beneficial for the taxpayer.

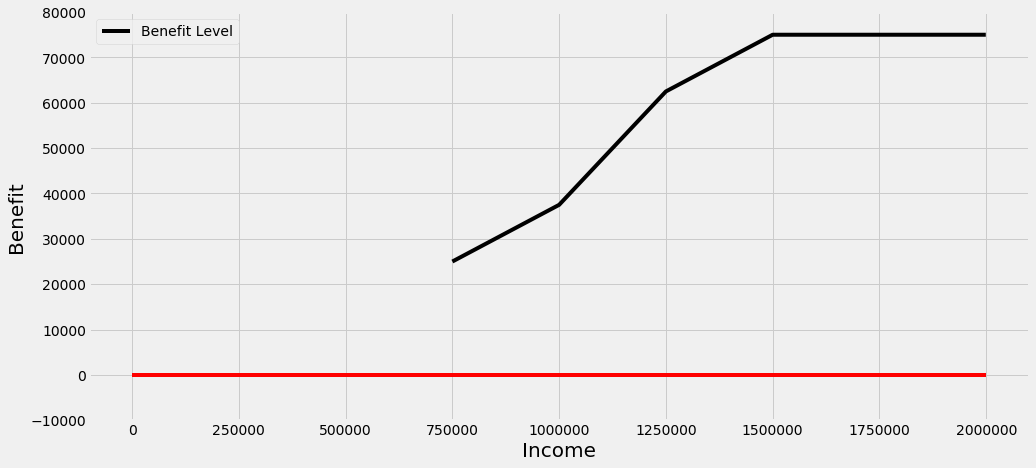

The results will be as follows: -

| Income before deductions | Taxes as per Standard Rates | Taxes as per New Rates | Benefit |

|---|---|---|---|

| 7,50,000 | 62,500 | 37,500 | 25,000 |

| 7,51,000 | 62,700 | 37,650 | 25,050 |

| 7,52,000 | 62,900 | 37,800 | 25,100 |

| 7,53,000 | 63,100 | 37,950 | 25,150 |

| 7,54,000 | 63,300 | 38,100 | 25,200 |

| ... | ... | ... | ... |

| 19,95,000 | 4,11,000 | 3,36,000 | 75,000 |

| 19,96,000 | 4,11,300 | 3,36,300 | 75,000 |

| 19,97,000 | 4,11,600 | 3,36,600 | 75,000 |

| 19,98,000 | 4,11,900 | 3,36,900 | 75,000 |

| 19,99,000 | 4,12,200 | 3,37,200 | 75,000 |

| 20,00,000 | 4,12,500 | 3,37,500 | 75,000 |

We have started with a income level of Rs. 7,50,000/- and increased it by Rs. 1,000/- in each row,

till we reach to the income level of Rs. 20,00,000/-. There are a total of 1251 rows in the above table. It

would take many pages to print it completely.

In the interest of sanity (of author and reader both) instead of printing the table, let us try to 'draw' it.

Yes, we will ask Python to draw the results of the table on a graph.

If we plot the graph of Income and Benefit we will get the following results.

This graph is much more informative. But what does it represents?

On the horizontal axis, we have different levels of income. On the vertical axis,

we have the amount of benefit a person will get if he opts to pay taxes according to Section 115BAC.

If the benefits are positive then the new scheme is beneficial and vice versa.

We can deduce many insights from the shape and other properties of this graph.

For example, we can see that the curve on the graph is always above the red line (which is the x-axis), in other words,

the benefits are always positive, this means that If a person claims no deduction at all

then the new rates are always beneficial for him

Although it may seem trivial, it gives us some powerful insights.

Such as if a person wishes not to claim any of the deductions mentioned above,

it will be beneficial for him to pay taxes according to the new scheme.

There can be many circumstances where this might be true.

An individual earning an income of Rs. 6,00,000/- may not be very enthusiastic about an life insurance policy of Rs. 1,50,000/-.

There can also be a case where a person is not willing to purchase any of the investments mentioned under 80C,

simply because he/she prefers liquidity and almost all investment schemes u/s 80C have a lock-in period.

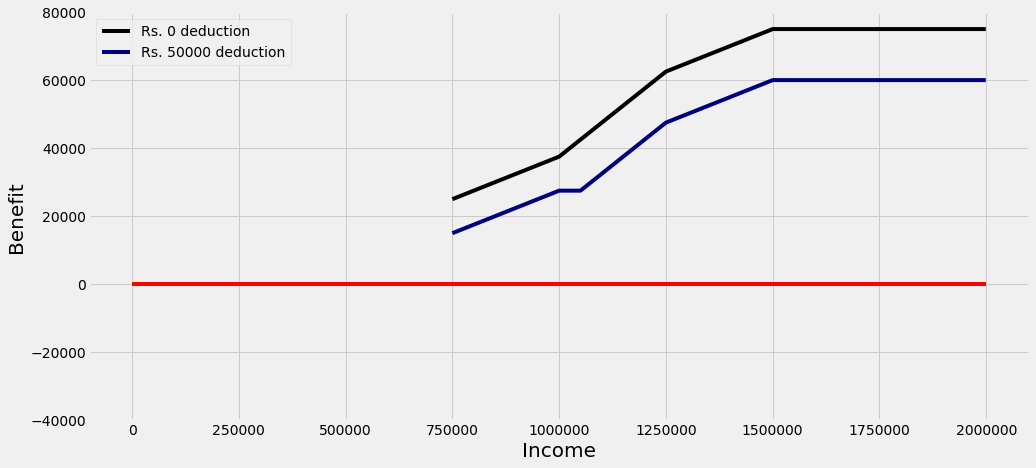

But what if a person wants to claim some deduction from the list mentioned above?

We can repeat the same exercise, with an additional assumption that the individual wants to claim a deduction of Rs. 50,000/-

In that case the curves will be as follows:-

Now things start to look a little more interesting. The black curve is just the same as above.

The blue curve shows us the level of benefits a person will get assuming he claims a deduction of Rs. 50,000/-.

We can observe that the blue curve is below the black curve.

The point is that the amount of benefit for an individual who claims a deduction of Rs. 50,000/-,

will be lower when compared to an individual who claims no deduction.

Let one thing be clear. The above para is not recommending that one should not take benefit of the tax deductions.

The only decision we have to make is whether to pay taxes as per new section 115BAC or according to standard rates.

All other things are simply given or fixed by some other criteria.

For example, say Mr. X is earning a salary income of Rs. 10,00,000/- and Mr. Y is earning FD Interest also of Rs. 10,00,000/-

In this case, Mr. X will get a Standard Deduction from his salary of Rs. 50,000/- so his income for income tax

calculation will be Rs. 9,50,000/- (Rs. 10,00,000 - Rs. 50,000). The question before us is whether Mr. X and Mr. Y

should pay income tax as per Section 115BAC or according to standard rates.

If we calculate income tax for Mr. X and Mr. Y, both will pay less tax if they opt for Section 115BAC.

But the tax saving by Mr. X will be Rs. 27,500/- whereas the tax saving for Mr. Y will be Rs. 37,500/-

It is not that Mr. X is losing or Mr. Y is gaining an extra Rs. 10,000/-.

All that can be said is that to Mr. Y, section 115BAC is more advantageous when compared to Mr. X.

Mr. X is not making a choice about standard deduction.

This makes sense, since we already have benefit of tax deductions the benefit of lower tax rate provided by Section 115BAC becomes

less and less attractive.

Now we have our second insight. As the total amount of deductions increases,

section 115BAC becomes less and less advantageous for a taxpayer.

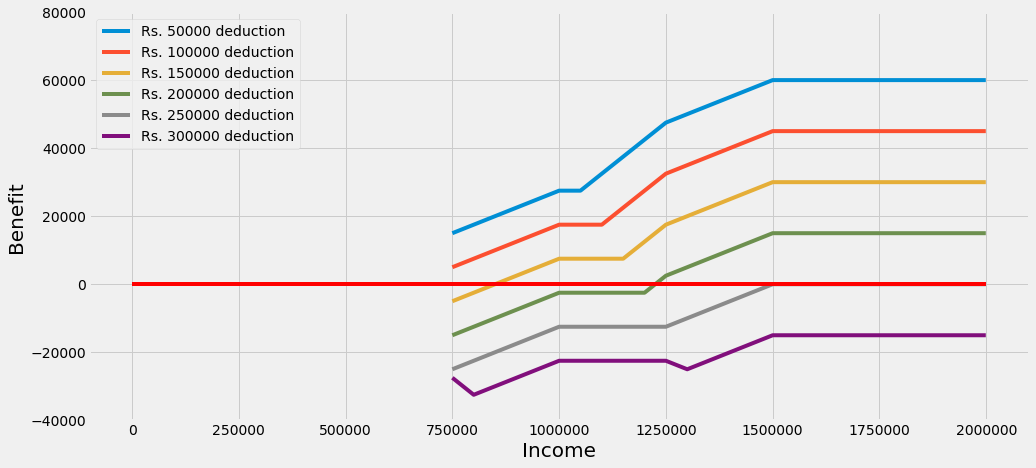

We can verify this if we plot curves for different levels of tax deductions.The resulting figure would look like this

Notice that all the curves with higher level of deduction lie below the curves with lower level of deduction.

This verifies our second insight

In the above graph, check the curve for Rs. 2,50,000/- deduction (the second last grey curve).

We can observe that it crosses the red line.

Any curve for deduction amount more than 2,50,000/- will always be below the red line.From this we can conclude as follows:-

if the total amount of deduction is Rs. 2,50,000/- or more then there will be a negative benefit (loss)

from opting the Section 115BAC (because all such curves lie below the horizontal axis).

This is the same rule of thumb that we stated earlier.

If the total amount of deductions is more than Rs. 2,50,000/- then

there is no benefit in opting for Section 115BAC as the tax amount according to standard rates will always be lower.

Now you know how the magic number of Rs. 2,50,000/- was determined

Shortcomings to our approach

This concludes our search for the rule of thumb to determine under what circumstances Section 115BAC is beneficial.

But why call it a rule of thumb? After all, we have written computer code, made graphs, analyzed tables, and

we have nothing but a general rule with exceptions to show for it.

The answer to such a question is that we have approached the problem only on a broad basis

with only one factor in mind, the Tax benefit, there are other factors to be considered.

One such factor could be liquidity. An individual may want to pay tax under the new section 115BAC, even if the tax amount is higher than

the tax as per the standard rates, why you may ask? Because he is unwilling to make any investment with any

lock-in period and has no other deduction available due to the nature of his income.

That individual might be confident that he can cover up the loss due to extra tax paid provided he has more funds

available at his disposal or has better investment alternatives which may provide better returns even if they

do not provide any tax-saving benefits.

Also, our approach has been graphical. We have determined the amount by observing and not by calculating any specific

break-even point(s).The reason is that there might be many break-even points.

Calculating several points for each level of income might not be that fruitful.

Also, we have assumed all income of the individual is taxable at the standard rate,

this might not be true when a person is earning income from capital gains that are taxable at special rates.

All such factors deserve separate consideration. So in the end, we only have a Rule of Thumb.

In this article, we have addressed a single question about Section 115BAC. Frankly, that is not all to it.

There are various other nitty-gritty details not discussed here because they deserve a separate article of their own.

Including all those details might make this article very much longer.

As a result, the reader might lose all his interest (assuming you have not lost it already.)

Let us know your thoughts on the article and on the section through mail and whatsapp. Criticism is always welcomed and appriciated

Thank You

Disclaimer

The views expressed in this article do not constitute any legal advise, although every effort has been made to make the information error free, the views expressed are not a substitue for legal advise. Kindly, contact your consultant before making any decision. The author is not liable for any loss or liability, financial or non-financial, contingent or otherwise, caused by use of any such information.

1. We are not calculating cess or rebate u/s 87A as they will only complicate the matter and provide similar results